Target maturity strategies have grown substantially and attracted over $4.4 billion in assets since 2022 — the worst year on record for fixed income — responding to investor needs in terms of outcome predictability.

By the end of March 2025, there were 44 target maturity ETFs available within Canada, with maturity dates ranging from 2025 to 2030. Investors had a range of options, including exposures to Canadian bonds, US bonds, government bonds and investment grade corporate bonds. Typically, these portfolios hold between 20 to 70 underlying bonds.

Let’s look at what led to this innovation.

The role of fixed income

Over the past few years, fixed income investments have exhibited more volatility than many investors expected, fueled by heightened inflation, rate changes, tightening credit spreads and geopolitical uncertainty.

There are three main reasons why investors are integrating fixed income into their portfolios:

- Capital preservation.

- Equity diversification.

- Income generation.

From the mid 1980s to the late 2010s, interest rates have generally moved ever lower, as investors have benefited from a relatively positive macro-environment and controlled inflation.

During that period, new options evolved to offer diversified fixed income — from individual bonds, to diversified fixed income funds and ETFs. This pooled approach removed constraints that individual investors faced, including liquidity, inventory and trading constraints. Investors have also benefited from increased choice of strategies and the availability of more sophisticated offerings.

Fixed income funds and ETFs are typically structured to be “perpetual” — meaning there is no fixed end-date. Instead of letting bonds mature, the portfolio manager will “roll” the exposure, selling bonds that are near maturity and buying new ones.

The trade off

Most individual bonds have a known maturity date and a fixed coupon rate, making the outcome very predictable for investors. This makes it relatively easy to match maturities to specific financial planning needs that have a known time horizon.

This is particularly valuable for investors who are approaching retirement, when the need for predictability and capital preservation become more important with the increase of sequence-of-return risk.

This is the dilemma fixed income investors faced: Try to build a predictable bond portfolio on their own, or buy a pooled investment vehicle, with less outcome predictability for their time horizon.

Investors have expressed their need for outcome predictability when buying fixed income funds and ETFs, in terms of expected returns and investment horizons, which are both features of individual bonds.

When buying a bond and holding it to maturity, investors refer to the yield to maturity (YTM), as an indication of the expected average annual rate of return at the time of purchase, if held to maturity. The YTM annualizes the future income (interest) plus/minus the gain/loss expected on the bonds at maturity — assuming no default.

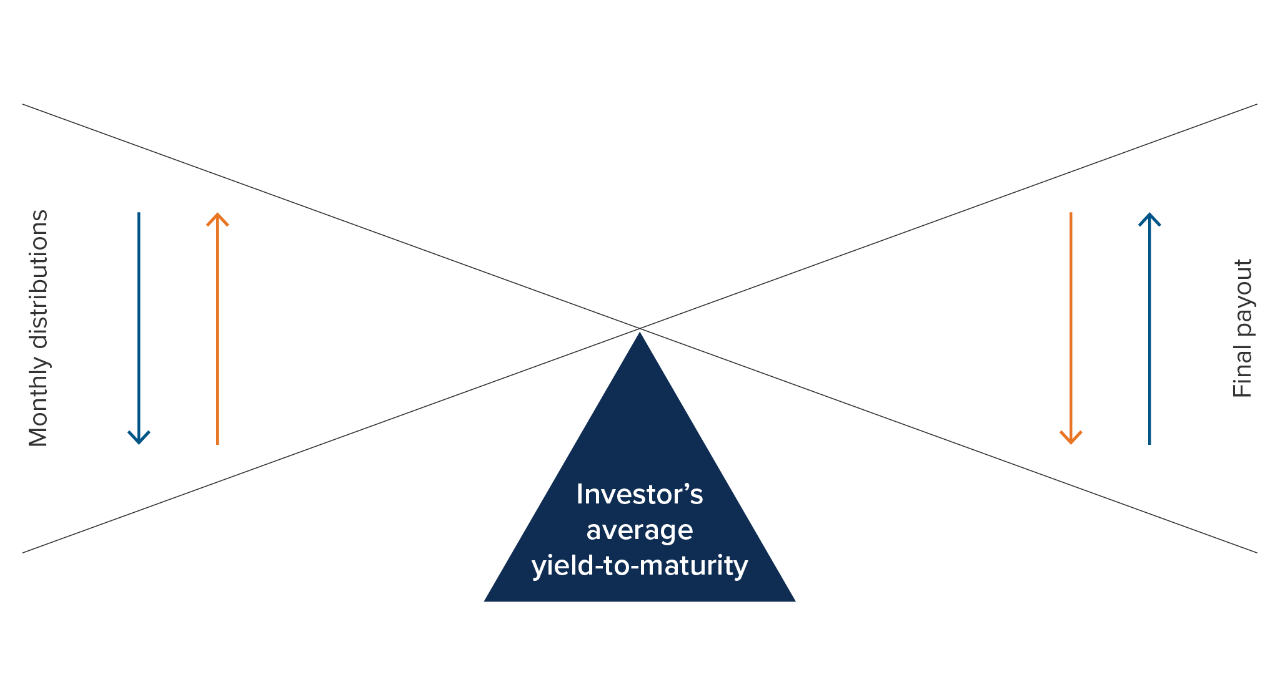

Increases (or decreases) in monthly distributions are usually counterbalanced by a decrease (or increase) in the maturity value, resulting in a relatively constant anticipated YTM.

The innovation

Enter the target maturity fixed income strategy. By holding bonds that mature within the same year, Mackenzie Target Maturity Bond Funds and ETFs offer access to a professionally managed, diversified bond portfolio, with a predictable outcome.

These solutions are designed to provide investors with a combination of different features from bonds, funds and ETFs at the same time:

- Bonds: outcome predictability (when held to maturity) similar to holding a bond and fixed maturity date.

- Stock: intraday liquidity (ETF)

- Funds: diversification benefits from holding different bonds maturing in the same year.

- Regular monthly income.

- Actively managed and possible tax-efficiency.1

Benefits of target maturity bond ETFs and funds

|

Target maturity bond funds |

Individual bonds |

Traditional bond ETFs |

Traditional mutual funds |

GICs |

Scalable across client accounts |

✔ |

|

✔ |

✔ |

✔ |

Diversified portfolios |

✔ |

|

✔ |

✔ |

|

Monthly distributions |

✔ |

|

✔ |

✔ |

|

Target potential performance at maturity known in advance |

✔ |

✔ |

|

|

✔ |

Duration declines over time |

✔ |

✔ |

|

|

|

Fixed maturity |

✔ |

✔ |

|

|

✔ |

Transparent intraday prices |

✔ |

✔ |

✔ |

|

|

As the bonds in the portfolio mature, the proceeds are held in cash and cash equivalents. When all the bonds have matured, the ETF will delist and will pay out a final distribution to unitholders, just like paying back the principal of a bond when it matures.

Addressing investors’ needs:

- Match foreseen liquidity needs with pre-set investment horizons for goal-based investors

- Capital preservation minimizing risk of daily mark-to-market losses

- Income, yield through monthly distributions

- Flexibility and liquidity if needed to sell before maturity

To learn more about the new Mackenzie Target Maturity Bond Funds and ETFs, please reach out to your Mackenzie wholesaling team.

Sources

1 Bonds trading at a discount to their par value may offer a tax advantage for investors in non-registered accounts over cash, GICs and individual bonds (purchased at their par value) as a larger portion of its total return may be derived from capital gains which are subject to lower tax rates than interest income.

Commissions, management fees, brokerage fees and expenses may all be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.